TL;DR:

- The report explores GameFi through an in-depth data analysis of Axie Infinity's Reach, Retention and Revenue.

- Using Covalent data, we’ve analyzed over 686M rows of on-chain Ronin data to give you unique insights into Axie Infinity's player model and revenue metrics.

- The NFT marketplace facilitated more than $4B in sales for over 1.5M different wallets.

- The bridge has more than $5B capital inflow into the Ronin ecosystem.

- The median wallet can break even after 4.5 months of gameplay with revenue of $192 per month and a total cost of $862 to build a team.

- Our previous report titled “Axie Infinity Growth Pt. 1 - Approach to 10M Players” for insights into player growth and retention.

1. Why is Axie Infinity exciting

The ways games monetise their user base has had three major phases over the last 20 years. First was the 'Pay-to-Play' genre dominated by the likes of Call of Duty, Minecraft, GTA, and many more. Second was the craze around 'Free-to-Play' (F2P) games like Fortnite, Farmville, Candy Crush and other mobile-casual games. We are currently seeing the emergence of the third phase known as 'Play-to-Earn' (P2E) which has been brought to popularity by Axie Infinity.

Despite this innovation, the GameFi space won’t ever reach its full potential without first understanding the data around user behaviour. Deep, granular, data on Ronin is extremely difficult to find, creating a barrier to entry for anyone trying to navigate this new and exciting genre of Web 3.

However, the Covalent API supplies full blockchain data transparency for every transaction, game event, and value transfer on Ronin. Using this data, we have researched the 3 most important metrics that describe the behaviour of users in the GameFi ecosystem.

- Reach - The growth of new players.

- Retention - How many players does the game retain over time.

- Revenue - How much money is captured by the different parts of the ecosystem.

You can now cut through the noise and form opinions of your own based on irrefutable blockchain data.

Quote from Ganesh Swami, CEO of Covalent

“ Transitioning from centralisation to self-custody distributes ownership. Ownership unlocks composability that's never been seen in traditional games. This composability means players can now fractionalize, collateralize, transfer, stake, and bridge their in-game assets. Our report provides a level of detail into play-to-earn economies that hasn't been seen before.

2. The Axie Infinity Ecosystem balancing act

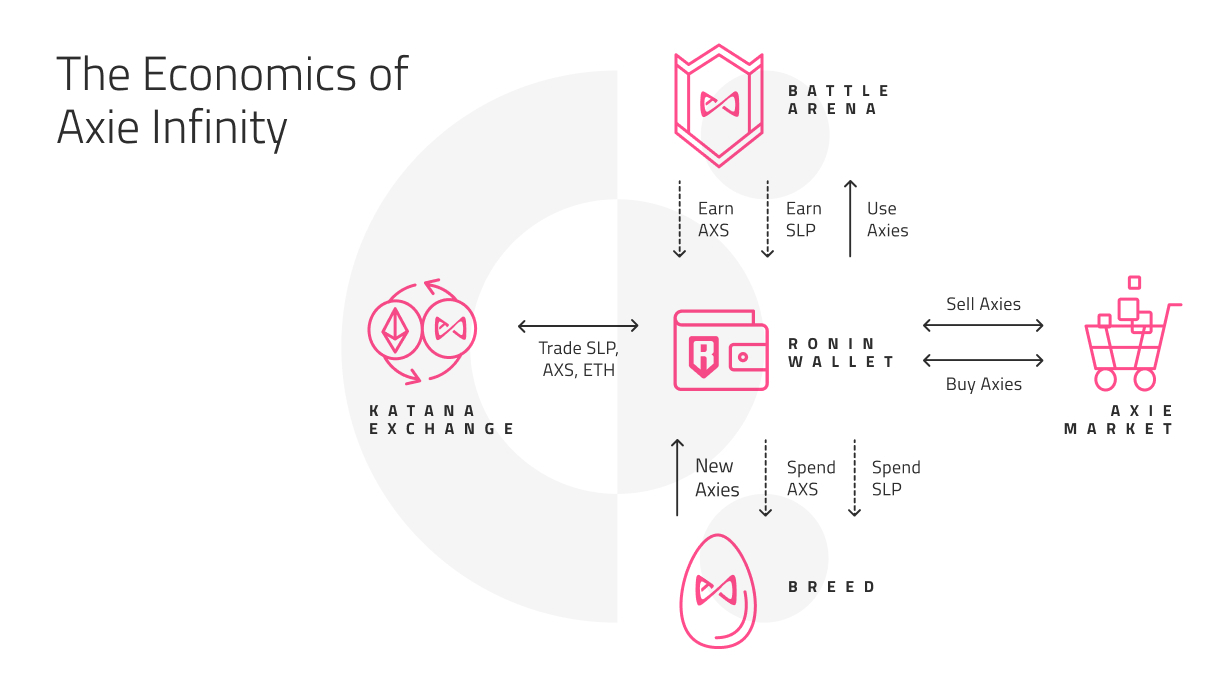

The visual above gives a high-level breakdown of how Axie infinity keeps value cycling around the ecosystem.

First though, the value must flow into a Ronin Wallet (center in the diagram above) and happens in three ways:

- Bridge from Ethereum to Ronin.

- Binance integration with Ronin.

- Ramp Network allows users to deposit directly into their Ronin Wallet.

After a user has funded their wallet, they can buy and sell on the Axie marketplace. If a user is looking to battle in the arena they'll need to buy at least 3 Axies. They can also trade or provide liquidity for SLP, AXS, and WETH on the Katana DEX.

Once a player starts battling, they begin earning SLP rewards which can only be redeemed every 2 weeks. Within this time, if a player shows exceptional skill they can be ranked on a global leaderboard to earn AXS as a prize.

As seen in the preceding diagram, these rewards (both SLP and AXS) are meant to flow into the breeding of more Axies. The SLP (which is generated when claimed) is burned upon the breeding of Axies. The AXS used in breeding is sent to the Axie Treasury and distributed as future rewards.

Retention comes from players wanting to play more to earn more, earn more to spend more, spend more to level up their team, and level up their team to earn more. Then the cycle starts over, theoretically capturing the value that enters the ecosystem. If SLP and AXS tokens leave the ecosystem and consequently aren’t used to breed more Axies, then they can't be recycled back to pay the current players in the battle arena. For the Axie Infinity economy to remain sustainable in the long term, the SLP burnt from breeding needs to exceed, or equal, the amount of SLP minted through in-game rewards. If players redeem more SLP in the arena than what is burnt from breeding, then the supply of SLP increases putting downward pressure on the price of SLP. If token prices fall then the earning potential drastically decreases, and players lose the incentive to play the game.

3. Guilds are hungry for data

On-chain data is the best way to 'cut through the noise' and understand why institutional money has chosen to allocate billions to the Play-To-Earn genre. But don't take our word for it - here's Marc Weinstein (@warcmeinstein) from Mechanism Capital, a VC firm that recently raised a $100M GameFi fund:

“ With real money on the line in GameFi, the importance of quality data analytics in gaming has never been more important. For example, we need high quality player metrics for guilds to better onboard and compensate scholars. As an investor, it’s also useful for us to evaluate real versus botted user growth. – Marc Weinstein, Mechanism Capital

In addition, the Axie community is one of the most vibrant and fun ecosystems on the market today. The sad reality is that people can't fully understand the ecosystem they love without granular analysis of blockchain data. Covalent's unique data architecture makes it the only product that can create this level of granular tooling required to piece together analysis on Ronin and the 26 other chains we index.

We add value to the Axie community - and many others - in the best way we know how - with data.

4. The median wallet has spent $867 purchasing Axies

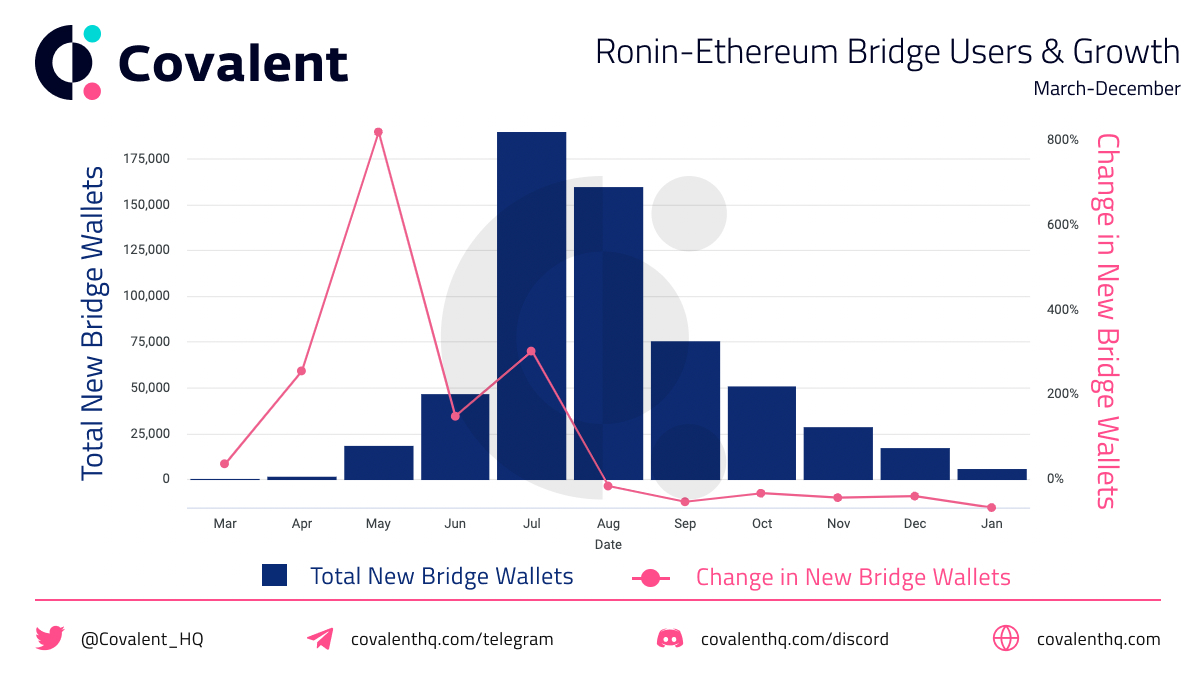

Before you can begin playing, you must first fund a wallet and buy three Axies. The most common way to fund a wallet is using the Ronin-Ethereum bridge. As of this writing, 582k wallets have bridged more than $9.8B worth of ETH, SLP, AXS, and USDC to Ronin. Conversely, $4.5B has been bridged back to Ethereum by 300k different wallets. The average deposit transaction is $5k and the average withdrawal is $4.8k but these numbers are skewed by large whales and scholarship program managers. The median deposit of $820 and withdrawal of $137 are a better representation for the typical player.

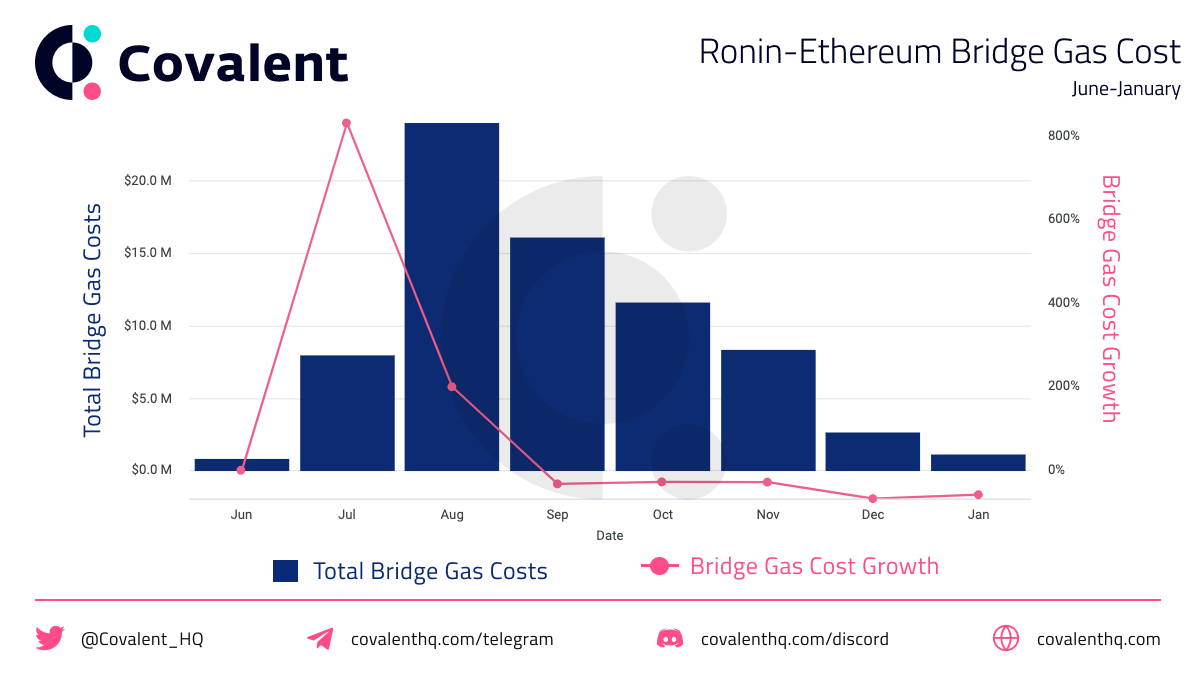

On top of the money that you need to put into the bridge, you also need to pay gas on Ethereum! So far, over $72M has been spent on gas for the Ronin bridge - an average of $25 per transaction. Gas due to bridge fees has been on a steady decline since August, with December falling 89% off the August high. This negative bridge gas growth is likely due to the Binance integration in September, but could also be indicative of positive growth in scholarship programs (which don’t require you to bridge assets and buy Axies) or negative new-player growth - we will discuss these possibilities in depth below.

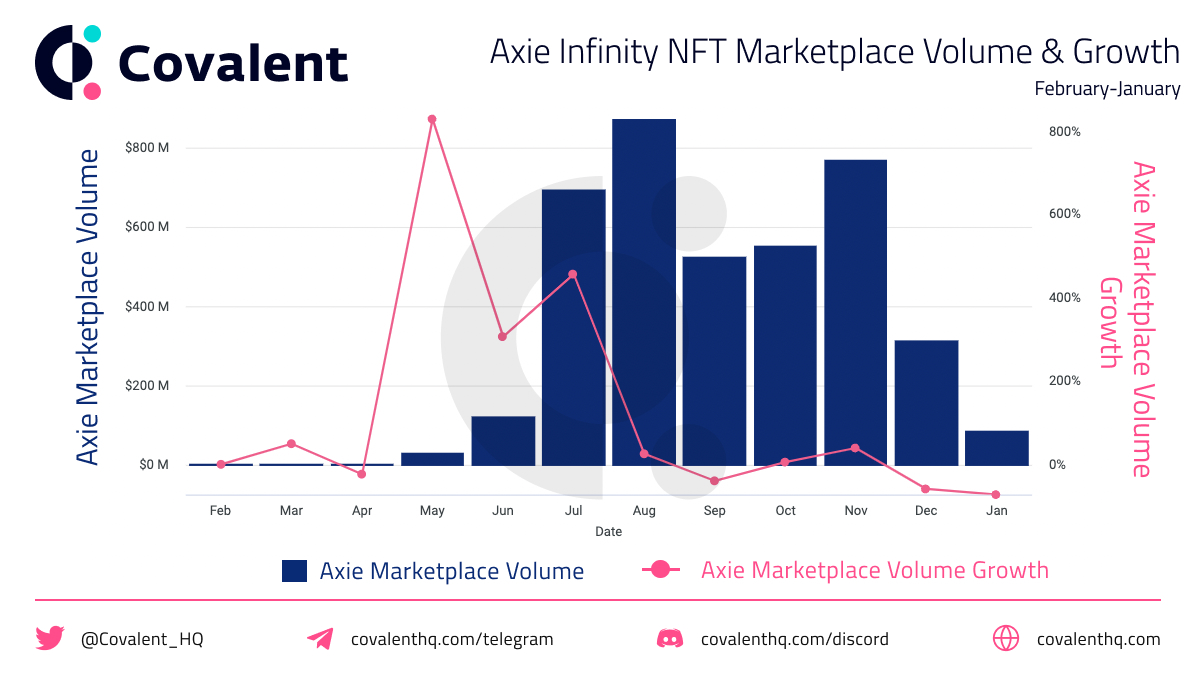

Again, to play, you need to purchase at least 3 Axies from the marketplace. To date, over 7.3M Axies have been bought/sold for a total of over $4B. There have been 1.45M wallets that bought an Axie, and 999k wallets that sold an Axie. The most valuable Axie sale to date was for 300ETH ($120k at the time, $950k now).

All of that considered, the median Axie has sold for $265 and the median wallet has spent $867 purchasing Axies - so you should expect to pay at least that if if you want to start out with Axies typical of the median player. However, Axie prices have come down significantly off their summer highs due to a decrease in marketplace demand - as seen in the marketplace revenue discussion later in this article.

5. Players take 4.5 months to break-even

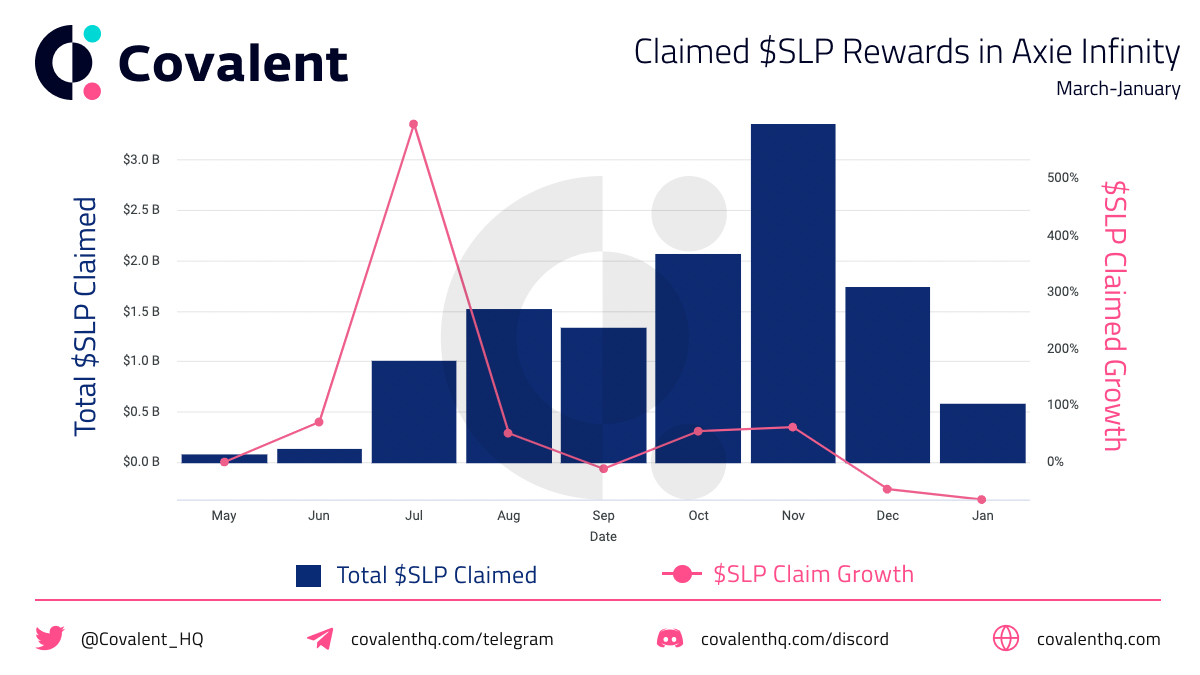

Let's dig into how much you can earn by actually playing the game (excluding DeFi, NFT swapping, and managing other players - which will be discussed in a separate article). In the last 6 months, $11.3B of SLP has been claimed across 6.4M wallets. This breaks out to about $192 per wallet per month. If we take the median cost to play of $867 per wallet from the previous section, then the typical break-even time frame is about 4.5 months.

It is important to note that the number of wallets is not necessarily proportional to the number of players because one Ronin wallet can be linked to multiple Axie gameplay accounts and thus one Ronin wallet can back multiple players (this is how the scholarship program works). That being said, we can still see the total amount of SLP claimed each month and thus the full picture of revenue generated for players (even if we don’t know exactly how many players there are).

To dig a bit deeper into the scholarship programs. We can look at the Yield Guild Games (YGG) - one of the largest Axie Infinity scholarship programs. According to the YGG 2021 Year End Retrospective, YGG reached 10,000 scholars by the end of 2021 and generated $13.6M in SLP revenue since the program began in April. According to the most recent YGG Asset & Treasury Update, they had 4,710 scholars in September, who earned a total of $1.24M through gameplay. This equates to $263 per user for the month of September. Based on a number of metrics that we will discuss below, it is not likely that YGG scholars are generating any more than this currently. Of that $263, 70% goes to the scholar, 20% to the manager, and 10% to the guild. This means the average scholar is making about $184 per month which annualizes to $2,209. The managers on the other hand are doing exceptionally well for themselves. A 20% cut split across 32 community managers equals about $7,750 per leader in the month of September!

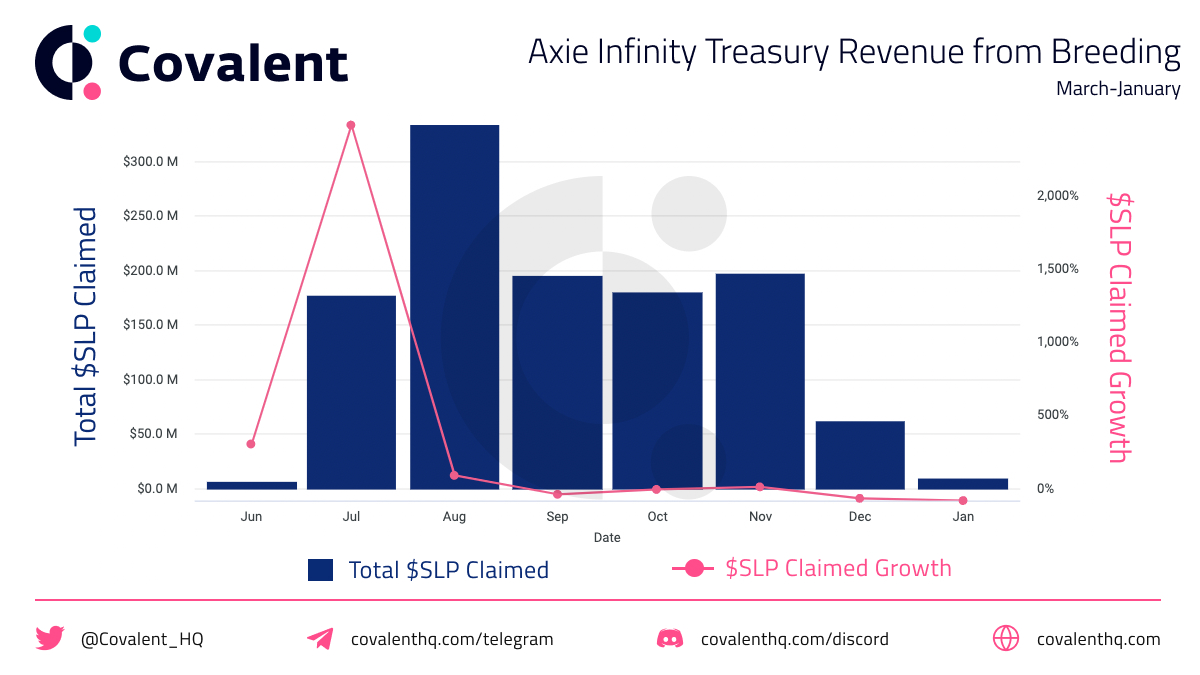

The chart below shows the monthly SLP claims and the corresponding growth. Claims grew to a high of $3.3B in November but December saw claim value decrease by 48%. This may be indicative of a cool-off in the Axie ecosystem as user growth declines, claim growth declines, and bridge growth declines.

6. Bridge volume is overwhelmingly in the Ronin direction

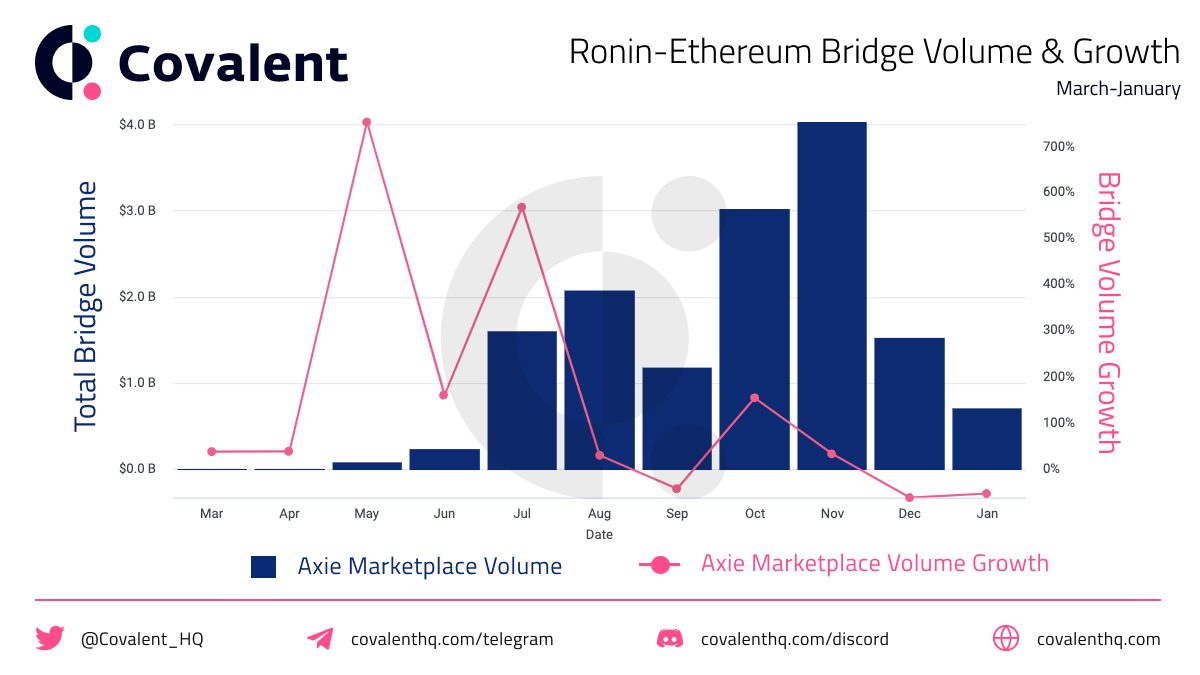

Is it too late to join the game? The simple answer is no, it isn’t too late. It might actually be a better time now than it was during the peak hype points. As mentioned above, the Ronin-Ethereum bridge is the main on-ramp into the ecosystem and gives an indication of either new users bridging assets over to Ronin or existing Ronin users taking profit and moving back to Ethereum.

The bridge volume is currently in a down-swing and has significantly decreased (both to and from Ronin) since its November peak. December saw a decrease of -59% compared to November. The peak daily volume was November 5, 2021, at $38.6M, and as of this writing, the daily average is down 90% off of that high ($4.8M). This indicates that there is no major capital flux between Ronin and Ethereum at the moment - capital entered July-November and is mostly staying put on Ronin.

Interestingly though, the story is not the same for the count of active bridge wallets (which we use as a proxy for users - though this is not necessarily the case as mentioned in the disclaimer above). The number of wallets using the Ronin-Ethereum bridge peaked back in July - well before the volume peak. The chart below shows a steady decline in monthly bridge users for the past 5 months at an average of -35% per month. In July, almost 190k wallets used the bridge to bring in assets from Ethereum - this past December there were just over 17k wallets using the bridge. It is also worth noting that bridge volume has been overwhelmingly in the Ronin direction, over 70% of the capital to flow into Ronin has remained there. The high volume inflow stemming from a low user count means that some very large players were moving into Ronin in November. This, paired with the high capital retention, could be a very positive sign for the future of Axie Infinity.

7. The makers of Axie Infinity earned $62M in December amidst breeding fees changes

The final pieces of the puzzle here are the revenues generated for the games’ treasury and for the developers at Sky Mavis. The treasury earns 0.5 AXS per breeding event and 0.05% of DEX trades on Katana. This amounts to $1.1B all time and $62M in the month of December. The December value is 68% lower than the $196M that the treasury made in November. This decline in December is expected - it is not indicative of a 68% drop in breeding. The breeding fees were adjusted on December 7th and the AXS fee (which made up about 80% of the fee) was cut in half. The SLP fee was tripled but due to the low price, still has not grown significantly in dollar terms.

The Sky Mavis team takes 4.25% of NFT sales on the marketplace. This marketplace fee equals over $170M in all-time revenue and $13.5M in December revenue. However, these revenues are extremely volatile and dependant on how many players there are. As mentioned above, the new user growth is down significantly and the NFT revenues along with it. Sky Mavis saw a 59% drop in revenue in December when compared to the $35M in November revenue from the NFT marketplace.

Playing the game is not the only way to capitalize on the recent traction of the P2E space though. There are in-game DeFi economies emerging with staking, farming, NFT flipping, and token trading. We will explore those topics in the next article!

Conclusions and Implications

We have looked at the GameFi ecosystem through the lens of the largest blockchain game from 2021 - Axie Infinity - and analyzed over 686M rows of on-chain Ronin data. Axie Infinity has seen almost 6.5M wallets claim over $11.3B in SLP from the game in 2021. The NFT marketplace facilitated more than $4B in sales for over 1.5M different wallets. And the bridge has brought more than $5B into the Ronin ecosystem. The median wallet can break even after 4.5 months of gameplay with revenue of $192 per month and a total cost of $862 to build a team.

While the aggregate numbers are staggering, the monthly numbers have sharply declined since November on all fronts. SLP claims have decreased by 48% since November, NFT marketplace sales are down 59%, and bridge traffic has decreased by 62%.

The Axie Infinity Economy - like any economy - will go through growth and contraction cycles so short bursts of negative growth are understandable. The $11.3B in community earned revenue should surpass $15B by the end of March 2022 as long as the ecosystem can recover from the slow month of December. Axie demand is low and Axie prices are correspondingly low so now is a great time to start a team and learn what the game is all about.

To track your earnings, compare yourself to others, or find some alpha strategies, check out the Covalent API and query any transaction or event from the Ronin chain here.